Drowning in Debt?

- Apr 23, 2020

- 5 min read

Start managing it, instead of it managing you. . .

UPDATED 2/24/2022. Originally published on 4/23/2020 – Since the pandemic, Americans have made bold moves to eliminate their credit card debt, and it is working. Did you know Americans wiped out a total of $49 billion in credit card debt in the first quarter of 2021 and increased their credit scores by 7 points on average over their pre-pandemic scores? This article discusses how people have paid down their balances and suggests some tools to pay down your balance.

—

Consumer debt steadily rises as the volatile economic market continues to raise concerns, and Americans are drowning in it. Debt can mean a financial disaster for those who don’t know how to tackle it head-on. But, it is possible to sit beyond this statistic and pay off your debt. It will simply take time, discipline, and possibly help from another professional or product.

Overview: Paying off Your Debt

There are several strategies for paying off debt. It is important to consider your level of debt before selecting a strategy for you. You may even consider combining strategies, which is fine. The key is to find something that will work for you. Paying off debt can seem overwhelming at the start, but that doesn’t mean you can’t take charge of your finances and eliminate a burden holding you back from living your best life.

How to Pay off Debt

Below I discuss several strategies you may incorporate to begin your debt payoff journey. While one might seem more feasible for your journey than another I do encourage all to tackle number one-creating a budget. This will jump-start your journey.

Create a Budget

The first step of the journey to pay off your debt is creating a budget. No, it isn’t fancy or some brilliantly complex concept. To best understand the extent of your debt and your overall financial picture, you must lay it out all out and follow your newly created budget to the penny.

Where is your money going? Take a good look at where you are spending your hard-earned cash. Are you taking five premium coffee breaks a week? How many lunch dates do you make? Tally up the utilities, gas, groceries, and car payment. Total every penny that exits your account, or wallet, in a month. Write that down.

Similarly, you need to account for everything that enters your account: paychecks, interest earned, gifts, even couch money. Make sure you have direct deposit set up for your paychecks. Fees to cash checks are a waste of money we cannot afford on this journey. Write down your total.

How do these numbers compare? Are you taking in more than you are spending? Great! What are you doing with those funds? Or, maybe you are spending more than you are taking in?

Analyzing where the money leaving your account is going is key to freeing up cash to put toward your debt. Create a want vs need list. What can you eliminate?

Now it is time to create next month’s budget with your new figures.

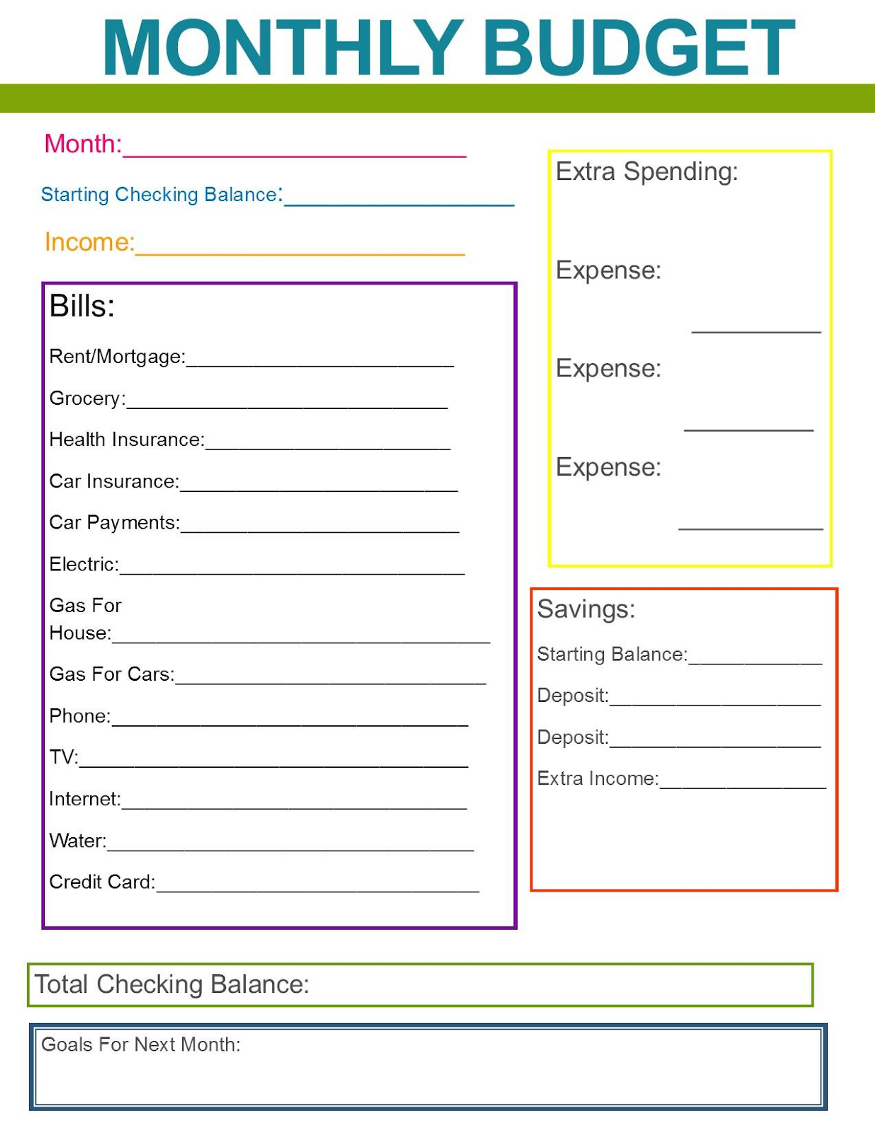

Take a look at a simple budget below:

Or, maybe you are one of those new-age, tech-savvy individuals. If so, I highly recommend using a budget app.

Throw Out the Plastic

After analyzing your superfluous spending habits and creating a budget, it is time to take drastic, but necessary, measures. Away with the plastic.

The best way to avoid building more debt is by removing temptation. Most spending is emotional and is a result of an impulse purchase. You must eliminate your ability to spend more than you have allotted on your budget.

Gather all credit cards and cut them up. I do recommend keeping one for emergencies, however. Just make sure you keep it in a lockbox.

But, it isn’t as easy as that. Credit isn’t just plastic anymore. It is accessible by the tap of a finger. Hide all lines of credit, that you can’t yet close, from your online banking views. Remove credit cards from your digital wallets, and for goodness sake, don’t log onto Amazon. Sorry, Alexa, I’m going to have to turn you off for a while. You have been my shopping wing-woman, so we are on a break.

Pay Most Expensive Debt First

Not all debt is created equal. Some types of credit that are more expensive, meaning, they have higher rates. They charge you more to use the money. Also, consider which debt is tax-deductible. Some student and home loans are tax-deductible. It may be beneficial to add these to the end of your debt payoff list.

Pay credit cards down first. Typically, you find credit cards have the highest rates. Ironically, consumers are quick to use this option when making purchases. It is all well and good if you pay it off within the 30 day period, but interest can start stacking if you roll balances over to the next month. At this rate, the rewards just aren’t worth it. It isn’t uncommon to find credit card advance rates at 25% APR.

Bank loans come in second.

While this is typical, your situation may be different. Pull each credit individually and make a list of their rates. Again, consider tax consequences. Don’t be afraid to ask questions. Being knowledgeable about your financial situation and how each credit item affects your financial situation is imperative to improving your situation.

Make Extra Dough

Maybe you simply don’t make enough money. That is okay. You can also start on your journey to pay off debt. Consider selling items you don’t use anymore or start a side hustle.

Again, you want to revisit the want vs need concept. Do you need that treadmill you haven’t used in 6 months? Do you need that fancy purse you only use on special occasions twice a year? Those items can bring in serious dough.

You can post these items on eBay, Facebook groups, OfferUp, or even Craig’s List. If safety is a concern, simply send through the mail.

Want to go a step further? Turn it into a business. Scavenge local thrift stores and revitalize items for resale.

Open a savings account specifically for debt payoff and deposit your proceeds. Once a month make a lump sum extra payment toward your debt.

Debt Snowball

Having a visual of your debt can be daunting. You might start to question your judgment. You may even begin to regret your decision to go on this journey. I can guarantee you will have the urge to go shopping. After all, that is how we got here. Don’t worry. You don’t need a therapist to get through this challenge. You simply must change the way you look at the debt.

This is a debt reduction strategy. Start thinking about your debt payoff as short term goals. Make a full list of each debt and the respective total. Sort from lowest to highest. Your goal is to pay off the lowest debt first and make your way up to the highest as you pay them off. That way, your successes are more plentiful, which will inspire you to continue on the journey.

You must also continue to pay your minimum balance on all your other debts. After all, fees add to your debt.

Consolidate Debt

As I mentioned earlier, not all credit is created equal. Sometimes, depending on your level of debt, it makes sense to consolidate your debt with the highest interest into a low-interest loan. That way, you can start saving money on interest. Instead, put that saved money toward the existing debt.

You must first consider your ability to qualify for this type of loan unless you already have a low-interest loan with enough of a credit limit for your transfer.

This will make your debt payoff simple. Throw anything extra toward this one loan until it is paid off.

On Your Way to Financial Success

Regardless of the method, or combination of methods, you use on your debt payoff journey it will take discipline, patience, grit, and maybe a few tears. Just remember, children do what feels good. It is time to access your inner adult and begin making sacrifices that will help you lead a more successful and satisfying life without the burden of debt.

Comments